- Problem

- Why make validator recommendations

- Who

- How

- The Inflation is Too Damn High

- How can you help if you’re a validator

- Summary

Problem ¶

Investment pools are essentially a form of unfortunately unavoidable abuse of POS networks.

I don’t like them and don’t think they add much value to the network. If they weren’t around there would be other, individual validators which is preferred for a network like XX Network.

But they surely must add some value otherwise they wouldn’t be rewarded, right?

Yes, they do. Their participation increases amount at stake required to get elected and thereby makes it more expensive to harm the network. That’s good.

Investment pools also increase the price of the coin as prospective investors save time required to understand what’s going on and choose among independent individual validators. I don’t care about this benefit. Let the coin be 40% cheaper, so what? This isn’t supposed to be easy, and the main purpose of the network isn’t to be an investment platform.

There are different ways to think about added security that results from the involvement of investment pools, such as: how hard is it to recruit 900 residential validators with 35,000 xx each compared to having 300 validators with 100,000 xx each? It’s probably more difficult and takes longer.

But I’d prefer that to having a bunch of centrally managed validators that can collapse at any time. It’s worse than having all nodes in the cloud! And in fact, pool validators also tend to run in the cloud, so that’s double bad for the network.

Imagine if a pool reaches 35% of all nodes and gets compromised by a corrupt administrator. Or unintentionally takes down the network (this we don’t have to imagine, it’s happened and MainNet had to be restarted because of them).

This, however, will eventually become a permissionless network, so I suggest we:

- Prefer and promote individual validators

- In matters of governance, vote against centralization and against pools when their interests diverge from the users’ (not validators - validators are of secondary importance)

Why make validator recommendations ¶

Because I can’t move my coins (no one can, at this time) which means I can’t send the same message by nominating them myself.

Main reasons:

- They know what they’re doing

- Nominating them does not increase centralization or risks to the network (as long as they don’t run a bunch of nodes)

- Some are active in the community

- Good node results

- Good conduct

- They have a small number of nodes (just one, at this time)

Who ¶

Here’s a handful of validators for your consideration, sorted alphabetically:

This is not a complete list of validators I would recommend or personally nominate. There’s close to 300 of us now, and I don’t know who runs which node so I likely omitted many good validators. But this should be enough to get you started.

How ¶

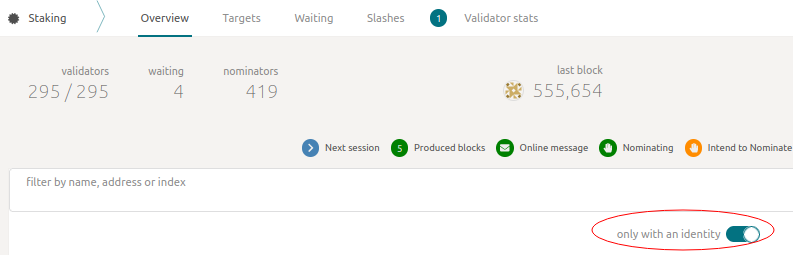

When you nominate, make sure you select named validators. Personally I’d never nominate a completely unknown validator.

Would I nominate a validator without on-chain identity? Yes, I may nominate a validator without on-chain identity if I otherwise knew him - and there are anonymous validators with five or 15 nominators who’ve made it - but you can’t easily tell whether it’s one guy with 15 accounts or something even worse.

Under Network > Targets, review names you want to consider:

- Pick 4-5 from each continent.

- Check their uptime.

- Check their own stake in

Network > Overview > own stake(column). - Check their Team Multiplier, which is a booster nomination from the XX Network team for early network participants (

Network > Targets > team multiplierin stake column). - Review their commission, both current and historic; validators who haven’t been around for a while, or whose commissions have moved wildly or went over 15% should be double-checked. Historic details are under

Network > Validator Statsin the explorer and you can get there without pasting validator’s address by clicking on the little chart icon inNetwork > Targets > stats(column). - If they have a Web site, check what they’ve been up to. To check go to

Network > Targets > $NAME(column) - click on a name and in profile card look forIdentity > Web siteor other forms of communication. - Check who are their nominators (more on that below) - do that in

Network > Targets > nominators(column). - And most importantly, make sure none of them are pool members. How can you tell? At this time:

- Pool affiliation stated on node page in MainNet dashboard

- Cloud-based (Google, etc.)

- Each node has several nominators despite outrageous commission (such as 20% or 50%)

- No on-chain identity

- No community involvement

Finally, pick 2-4 validators from every continent and add them all to the list of your nominees. If you have a small stake, save yourself some time and review fewer validators.

From that point on, an election algo built into the platform will elect best of them (sometimes all of them) before next era begins. This protects you from unexpected commission hikes or some of them not getting re-elected.

From time to time, check how you’re doing, rinse & repeat (go through that list above, and adjust your selection).

Everything else being similar (commission, uptime), I’d rather nominate a node backed by an individual. Even if their node’s ROI is slightly lower, I prefer individual validators. Consider this as a form of voluntary self micro-taxation if you will.

The Inflation is Too Damn High ¶

High returns for validators make it difficult to counter the effect of compound interest with organic growth of the network.

If the returns were smaller, pools would invest elsewhere, the network would grow slower, and it’d take longer to get to a scale where XX Messenger and other applications can be useful. So returns are higher, and it is what it is.

I wish the returns were lower, but they’re not. We can only try to mitigate this problem.

How can you help if you’re a validator ¶

First, individual validators should actively benchmark themselves against pools and contribute to joint efforts to reach out to nominators which is always done better by centralized pools (which is why they prosper), so the smaller that gap is, the better. When I say to benchmark, I mean in terms of commission, uptime and otherwise. We need to demonstrate and differentiate ourselves with responsibility, quality, stewardship and competitiveness.

Second, once we can move coins, each of us should nominate worthy peers with at least token amount of coins as a form of endorsement or recommendation for others.

This isn’t to reward them. No one will get elected because you nominated them with 1000xx, and you won’t notice if you made 225xx or 217xx nominating them over 12 months (even if you were, I’d consider that 8xx difference a tip for their XX Wiki contributions or helping others on the forum or in chat). But nominators unfamiliar with who’s who will use your votes as reference, which is where the value is of your endorsement lies.

While writing this it occurred to me I’ve reinvented a webring. They worked well for a while!

Summary ¶

On the whole, investment pools’ involvement is parasitic, counterproductive (decreases number of individual validators), risky (completely centralized and usually public cloud-based) and therefore damaging to XX Network.

Objectively, economies of scale make it impossible to get rid of them, but with small improvements to our nomination and community engagements, we can lessen their impact on the network.