- Introduction

- Commission is too low

- Validator return vs. stake

- Nodes stuck staking on themselves

- Expected effect on XXV nodes

- Summary

Introduction ¶

A plan for adjustments regarding Team Multiplier and Team-sponsored validator commissions was published earlier today.

I support the plan because it’s certain to fix most, if not all, problems mentioned in it.

What follows is my current thoughts regarding the problems and solutions proposed in the document.

Commission is too low ¶

The Team’s rough estimate of monthly costs required to run a node is 800xx.

Assuming $1=1xx that is generous, but not very wrong. My own estimate is 400xx.

According to their assumption I’m running XXV2 at a loss (3% commission) and 10% is closer to break-even commission.

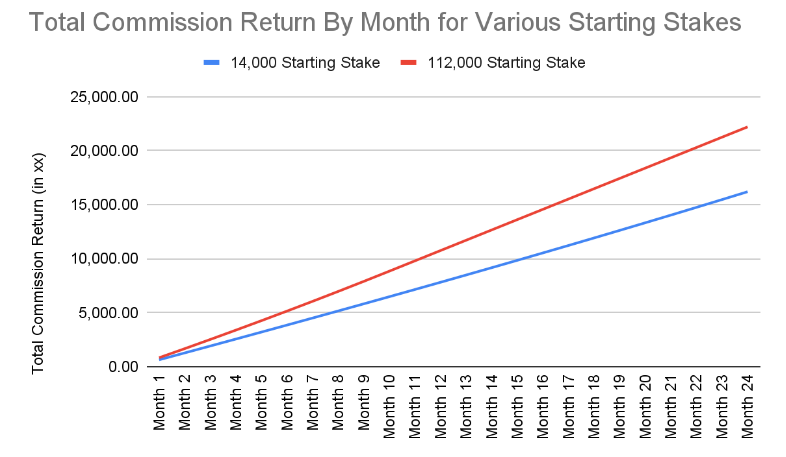

One of the goals here is more equitable earnings. This chart illustrates the challenge.

The problem here is there’s nothing anyone can do to prevent the larger validator from setting up eight smaller validator nodes. But I think that’s a known weakness or fact of POS, and cannot be solved in general.

They’d have to do that without Team Multiplier, so the proposed solution does work to address their goal (equity) for Team Mutliplier-backed validators.

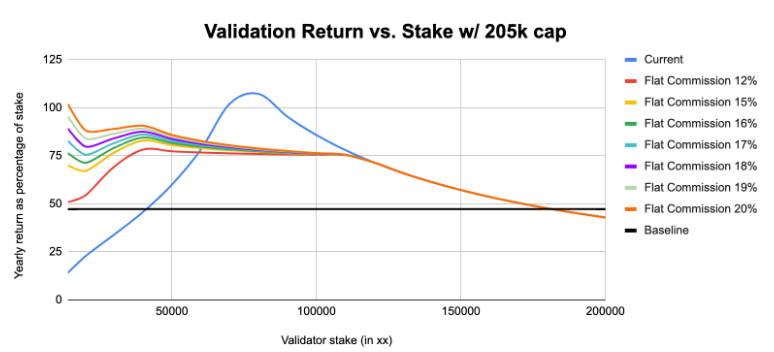

Validator return vs. stake ¶

The proposed maximum rate of 18% regardless of stake would yield best results with approximately 30,000 staked at your node.

This means it would be advantageous to not over-stake and allocate surplus coins for nominating other validator nodes.

Each validator (in theory) has only his own node so the more obvious approach - to stand up N nodes with 18% each - can’t work as N-1 nodes would not qualify for Team Multiplier and coins can’t be moved in any case.

So, given this new rule of flat maximum commission, I will probably do something along these lines:

- Stake XXV (which qualifies for TM) node with the minimum stake required to get elected - let’s say initially that would be 32K

- Use the rest to nominate other nodes - both TM-backed and non-TM-backed

- Nominate own node XXV2 which currently has a 16K stake, to bring it to around 30-50K xx

- As I have only two addresses (XXV, XXV2) the rest could be used to nominate other nodes - probably non-TM backed, but exclude pools and whale nodes

Page 7 has this interesting quote:

Validating within the Transition Program with a stake of under ~50k is not worth the risk when compared to simply nominating

I think the first part menas it’s very easy to drop out of validator pool and miss on next era’s earnings, but as XXV2 nominators and others who looked into my second node know, it’s done well and has been consistently elected.

The second part is right - I could have made more nominating, but not everyone is driven by short-term gains. As I mentioned in earlier posts on this topic, my approach is twofold:

- Build validator reputation at the expense of short term gains

- Take the hard path, compete with value, and constantly improve

Nodes stuck staking on themselves ¶

This part has been painful. For over 80 eras XXV has had surplus coins used for self-nomination without any gain.

On the other hand, XXV2 with its 15-16K stake has been running at practically zero profit.

To be clear, XXV did benefit from other problems that adjustments proposed in this document will solve - for an example, until now Phragmen has never allocated significant amount of nominator investments on TM-backed nodes so all of those with TM-backed nodes got close to 100% of their node’s earnings regardless of commission they set. This worked great for folks with 50 to 100 thousand coins, but not great for validators with >100K in their wallet, which includes XXV.

In fact it was so pointless that I’ve unbound 70K from XXV and even cut its commission in half (it’s 5% now), just to get some nominators. And yet, I have none and so I take all earnings from the node.

Expected effect on XXV nodes ¶

Current situation:

| Node | Stake (K) | Commission | % of earn | xx/day | Comment |

|---|---|---|---|---|---|

| XXV | 150 | 5% | 95% | 310 | No nominators, 310xx earn |

| XXV2 | 16 | 3% | 3.5% | 20 | 400K in nominations, 300xx earn |

| TOTAL | -* | 330 |

* I have some unused xx parked in XXV account, but it’s not being used (as explained above)

After upcoming changes:

| Node | Stake (K) | Commission | % of earn | xx/day | Comment |

|---|---|---|---|---|---|

| XXV | 50 | 5% | 20% | 77 | 200K in nominations, 310xx earn |

| XXV2 | 50 | 3% | 20% | 69 | 200K in nominations, 300xx earn |

| 3rdP* | 150 | 0% | 20% | 3 x 54 | 200K by others, 270xx earn |

| TOTAL | 250 | 308 | 22xx/day less |

* “3rdP” (3rd party) assumes nominating three other validators who charge a 10% commission using 50K on each

This probably isn’t very accurate, and a lot depends on how stakes will really get distributed by all and among all, and what other validators and nominators do in terms of their commission strategy.

But I think it’s safe to say the impact on my operations will be a small loss of revenue.

Summary ¶

I support these changes, although it appears personally I won’t benefit from it in the short term.

These changes are significant on their own, but there are other significant changes that will be happening in coming days:

- Geo-multiplier is changing next week. What’s that? See here.

- Coins from Nov 2021 sale have not been fully distributed and when they do - maybe later this week - stakes and competitiveness may change for both those who bought and who didn’t

Because of all that, this month is going to be very impactful for most validators (at first sight it seems those with 100K and one node are going to be less impacted).

Note that my XXV2 commission plan states that the node may charge up to 5% commission by February 17. I haven’t adjusted it to 4% yet and I currently do not know if I’ll adjust it at all, but as always:

- if I adjust XXV2’s commission to 4 or 5% on or after February 17, 2022, that will not be specifically announced as it is already in the plan

- if I decide to adjust it to a higher value, I’ll give a 30 day notice, and not implement changes before that

- I intend to to provide value, so keep XXV and XXV2 in your list of favorites in xx Explorer